back again with me sintarahmawati for this time i will introduce QURREX to you,

let's see our article below

What Is QURREX

Qurrex ecosystem

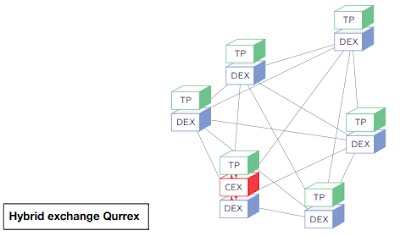

The Qurrex multifunctional trading platform is a hybrid system that consists of:

• a centralized node, which is comparable in its effectiveness to modern, cutting edge traditional exchanges;

• client functionality that meets the demands of users of leading exchange and FX brokers;

• a blockchain network which, on the one hand resolves problems of secure storage and eliminates middlemen, and, on the other, provides the user with aggregated liquidity from all network nodes, including the centralized platform.

In reality, Qurrex is setting the industry standard in the crypto-economy for a universal cryptocurrency exchange – one which existing platforms will eventually achieve only after years of independent effort. The platform will become the first cryptocurrency exchange based on high performance architecture from the leading international trading platforms. Rather than respond to the market demand of “yesterday”, it is designed for the future – for the coming growth explosion in cryptocurrency trading.

Moreover, the project will become an important factor in the development of the crypto-economy, as it not only satisfies the demands and solves the problems of current users of existing exchange platforms, but also creates favorable conditions for a new wave of participants, those not currently represented in the crypto world. As a demo-model, we’ve prepared a test web version of the trade terminal which will serve as the interface for our exchange system.

The test version is able to reflect current quotations for key cryptocurrency pairs, provides trading and analytical capabilities, and supplies a newsfeed from various sources. At present, the client end of the service – the platform’s functionality for social trading and investment – is 60% operational. At the back end of the exchange system, the concept of delivering the CEX and DEX has been developed, and work has begun on separate sections of the system, for a readiness level of around 20%. By the start of February 2018, the order-matching module will be launched in test mode and presented for external load testing.

BACKGROUND AND SOLUTION OVERVIEW

Originally, the Qurrex platform was designed exclusively as a centralized cryptocurrency exchange system. The reason for this was related to the team’s background: having worked for over 10 years on the creation of various exchange and broker systems and products for the traditional markets, we inadvertently became adherents of this approach. However, research into distributed networks as part of delivering the current project led us to new approaches and tools for solving many of the problems that we had encountered over the course of recent years. Here we refer, first and foremost, to the need to increase liquidity of separate instruments, as well as to increase clients’ confidence in unregulated infrastructure providers.

The outcome of our investigations was the understanding that, in order to create an effective exchange system and meet the demands of a wide circle of users, what is necessary is the harmonious merging of centralized and decentralized elements.

The main thing we understood was the fact that, within an infrastructure set up to handle various assets, the potential of the community behind the public blockchain networks must be taken into account, as it is precisely this community that is the

basis of the future crypto-economy.

In order to provide clients with user-friendly tools for executing operations and maximizing liquidity, we formulated our approach in the following way:

• The centralized exchange (CEX) will, in the long-term, remain the most effective solution in creating maximum possible liquidity across the majority of types of trading instruments;

• At the current time, it is only within a centralized infrastructure that effective creation of partial pre-deposit of funds is possible (the function of guaranteeing the fulfillment of obligations of the transaction party is always undertaken by the central link of the infrastructure) and this technology, in our view, will ultimately be introduced onto the cryptocurrency market;

• Decentralized exchanges (DEX) with high capacity remain, unfortunately, an unattainable goal in the medium term, whereas clients need a high-quality service now.

Given this, we believe that:

• Eventually, obstacles to the creation of a high-capacity DEX will be overcome

• DEX is an indispensable tool for creating liquidity in low-liquidity instruments such as tokens issued as part of an ICO or the numerous altcoins;

• DEX is a natural protection from those technical problems which inevitably arise from time to time in the central node of any centralized system;

• DEX is the best understood and most transparent mechanism for lowering the risks around the function of the infrastructure’s central link, albeit it at the cost of other product qualities (operation processing time, for example).

This approach lies at the heart of our system and inspires us to simultaneously create a successful, advanced, and effective centralized project, and to move forward, heeding the call to build and utilize decentralized systems.

CURRENT SOLUTIONS

Look new Clarification and detailization of the DEX concept at the page 56

Attempts by developers to solve the problems of speed, liquidity, collateral and the algorithm for matching trading operations have led to the rise of decentralized trading platforms dependent on centralized services, which resolved the issues of keeping order books, keeping reserves for collateral, matching incoming orders and selecting the technology for mutual settlements. Such centralization raised the question of solving the global problem of the presence of a vulnerable middleman. From our point of view, the majority of technical solutions within these projects are essentially marketing innovations aimed at securing better product sales.

News & Announcements

Public pre-sale term:

Public pre-sale period: 27 February - 27 March

Fixed selling price: 800 QRX = 1 ETH or equivalent in BTC / LTC

Volume min: 15 ETH or equivalent in BTC / LTC

Maximum volume: 17 m QRX

Bonus policy for public pre-sale:

For contributions from 15 to 30 ETH, we will credit 5% additional tokens;

For contributions from 30 to 150 ETH, we will credit 15% additional tokens;

For contributions from 150 to 750 ETH, we will credit 25% additional tokens;

For contributions from 750 and over ETH, we will credit 40% additional tokens.

For each interval, the upper limit is not included.

Full terms and conditions

QURREX Integrates the Bancor Protocol to Provide Token Litasity to Crypto Currency Purchasers

We now announce the integration of the Bancor Protocol to provide sustainable liquidity for Qurrex's Hybrid D (C) EX platform.

Chairman of the Qurrex Supervisory Board Joined the Qurrex Team Leader

We are pleased to announce that Konstantin Sviridenko has joined the Qurrex team as Chief Business Development Officer.

Great news: The matching module of Qurrex CEX is now available for load test

If you want to participate in the creation of a new generation exchange join the test process now! Send an e-mail to: matching@qurrex.com.

Pre-sale Qurrex Token Start February 7th with Non-Public Offer For Whitelist Participants

We at Qurrex.com, first of its hybrid cryptocurrency exchange, are keen to announce the start of a personal token sale preliminary.

Main feature

HIGH-END PERFORMANCE, CORAL EXCHANGE MODULE SCALABLE AND RELIABLE

Throughput> = 70,000 trx / second.

Latency: <= 650μs at 99%

Capacity> = millions of connections

No data missing

HIBRID INFRASTRUCTURE

Integration of CEX and DEX with Single Order Book

CEX with high-end performance for algo traders and HFT

DEX with the high liquidity of the Single Booking Book

NEXT GENERATION SECURITY LEVELS

Traditional Exchange System Security Infrastructure

Safe В «cold storage»

«Hot» wallet insurance program

Supervision by a recognized IT Security Company

WIDE FUNCTIONALITY

Algo trading functions embedded in the GUI

Auto-copy trading signals

A wide range of analytical tools & charts

Social Trade Segment

Information Services (Real-Time Market Sources and Analytics)

Non-Trade Segments (Corporate Services, Market Technology, Trade Management Services)

LIQUIDITY

We plan to provide the Qurrex with high liquidity thanks to:

Cooperation with large liquidity providers

The liquidity fund of Qurrex is sufficient

Best practice in launching new instruments

TRANSPARENCY

We will be the first in the cryptomarket to act as a traditional public company

Maximum formalization of all processes (rule book, etc.)

Regular disclosure of financial statements and reports

Annual audit by Big 4

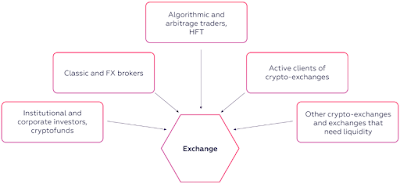

Our customers

Hybrid architecture

SYNERGY FROM:

Blockchain technology - ensures safe storage, eliminates intermediaries and provides aggregate liquidity from all network nodes, including centralized nodes.

Centralized node - centralized exhange (CEX) with performance comparable to modern, leading stock exchanges

LEADING FUNCTIONS OF HYBRID EXCHANGE:

aggregate order book establishment based on citations collected from all system nodes (both centralized and decentralized nodes);

the distribution of aggregated order books to blockchain nodes;

choice of blockchain nodes with the best instrument / quotation price to place orders sent by the client (if the order can not be marketed, it is included in the order book of the original system node);

sending orders to selected system nodes (for marketable orders); entry of information on the order into blockchain (for order queue);

confirmation receipt of implementation.

BEST EXECUTION LOGICS:

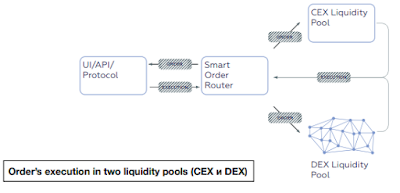

Each node of the hybrid exchange provides the Best Execution service to the user. Brokerage firms operating in countries with emerging financial markets are required to provide the Best Execution service. In Qurrex this service is implemented by a special module - Smart Order Router, which is part of all blockchain nodes, including centralized nodes (CEX).

Qurrex DEX blockchain is built from two types of nodes: confirming user nodes and nodes. The DEX protocol allows confirming nodes to fill other nodes as commissions for transactions and transactions. Commission is charged in transaction cryptocurrency (transaction).

There are special types of trading commands: DEX Cross-Chain cross-platform atomic orders (transactions). Cross platform commands are only charged once, when placed in a decentralized node. The order is included in the block as a DEX transaction, while the node confirms their commission fee.

Qurrex invented special cryptocurrency (qBTC, qETH). Traders can redeem this cryptocurrency through DEX and the transaction will be charged for the transaction itself, not for a separate blockchain transaction.

TOKEN-SALES

Token Symbol: QRX

Standard token: ERC20

Token type: utility

Total token supply: 70m

Total tokens on sale: 55m

Total token for pre-sale: 17m

Public pre-sale period: 27 February - 27 March

Sales period: April 02 - April 16th

State merge - Cayman Islands

Token Sales Structure

Roadmap

2001-2014: Legacy Product

NOV 2017: Qurrex prototype

FEB-APR 2018: Token-sale

JUN 2019: Qurrex trading functional

SEP 2019: Social trading services

DEC 2019: Hybrid platform

Details Information:

Website: https://qurrex.com/

Twitter: https://twitter.com/qurrex

Facebook: https://www.facebook.com/qurrex/

Author: (blackr15) https://bitcointalk.org/index.php?action=profile;u=1123100

Komentar

Posting Komentar